how much is the nys star exemption

The 2022 STAR exemption amounts are now available. New requirements for the Enhanced STAR exemption in NYS.

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Basic STAR averages about 800 a year and Enhanced STAR is about 1400 a year.

. The Maximum Enhanced STAR exemption savings on our website is 1000. There are two types of STAR exemptions. Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year.

The STAR savings is substantial. STAR helps lower property taxes for eligible homeowners who live in New York State school districts. Basic STAR Exemption and Star ENHANCED Exemption.

What is the basic STAR exemption. The basic STAR exemption will be available to all residential property owners regardless of age or income starting in school year 1999-2000. 3 rows It is necessary that you own a home and have an income of 50000 or less owner and their spouse.

To qualify the adjusted gross income must be under the State specified limit for the required income tax year 500000 for Basic 86300 for Enhanced and is eligible for a. The formula below is used to calculate Basic STAR exemptions. How much is NYS Enhanced STAR exemption.

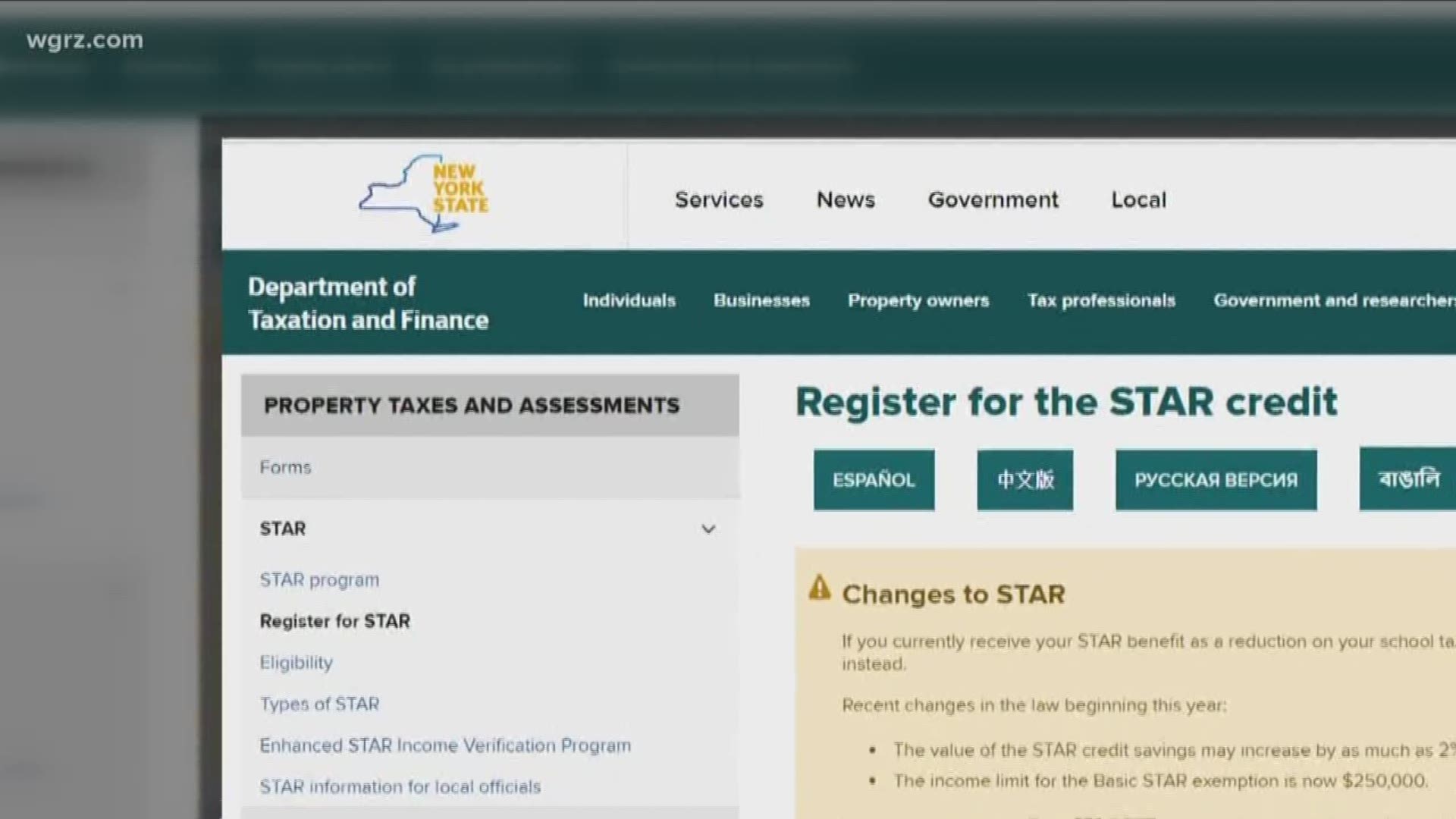

Enhanced STAR is available for seniors with incomes. The check goes to homeowners who are eligible for the usual STAR tax break and make less than 250000 a year. The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as much as 2 each year but the value of the.

The total amount of school taxes owed prior to the STAR exemption. The average benefit in Upstate NY is 970. Thursday January 3rd 2019 243 PM EST.

The New York School Tax Relief Program also known as STAR provides New York homeowners with partial exemptions for school property taxes. If you earn less than 500000 and own your. The Basic STAR exemption is available to all eligible homeowners with incomes below 250000 regardless of the owners age.

Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR. 20222023 STAR exemption amounts STAR exemption amounts and maximum savings now available online. While the maximum annual income eligibility requirement for Basic STAR remains unchanged at 500000 whats changed is that only those whose income is 250000 or less.

There are two types of STAR benefits depending on household income. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or. 5 rows If you are currently receiving STAR or E-STAR as a property tax exemption and you earn.

Beginning in 2016 any homeowner who is applying for the first time on a property meaning you have NEVER had any STAR exemptions. However STAR credits can rise. If you owned the property on March 15 2015 it is your primary residence and you received the STAR exemption for the 2015-16 tax year you may qualify to keep the STAR exemption.

WENY The New York State Department of Taxation and Finance is.

The School Tax Relief Star Program Faq Ny State Senate

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Resource Overview For A Universe Of Stories

Nys Thruway Western Star Highway Maintenance Snow Plow Westerns

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Lower Your School Taxes With The New York Star Program

Grade 6 Math Assessments Bundle Test Prep Engage Ny Modules Editable Math Assessment Math Sixth Grade Math

Star Property Tax Credit Make Sure You Know The New Income Limits Greenbush Financial Group

Home Sunshine Ragdolls Llc Nys License 1163 Tica Sunshinragdols

Ny Star Program Registration For Homeowners Updates To The New York Star Program And How To Register F Students Day Social Studies Teacher Democratic Society

New York Property Owners Getting Rebate Checks Months Early

Star Property Tax Credit Make Sure You Know The New Income Limits Greenbush Financial Group

Many Homeowners Face A Choice On How To Best Get Their Star Wgrz Com

5 Things You Must Know Before You Call Your Window Company How Much Does Glass Replacement Cost Glass Replacement Window Replacement Cost Window Replacement